Grantor Trust Powers Internal Revenue Code Section

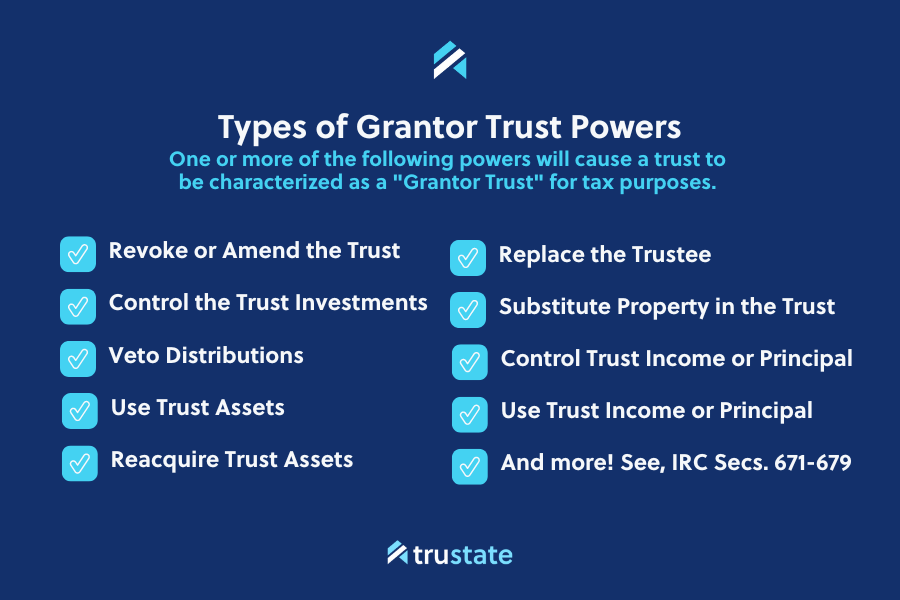

Under Sections 671-679 of the Internal Revenue Code, there are several powers that Grantors of a grantor trust may retain or exercise. These powers are important because they can impact the tax treatment of the trust and its income. It is important to note that if any of these powers are present, the trust will generally be treated as a grantor trust for income tax purposes. Here are some of the different grantor trust powers under Sections 671-679 of the Code. Note that Section 671 is discussed out of order, at the end, since it relates to the powers of a non-adverse party:

Power to Control the Trust Investments - Section 673

- If the Grantor has the power to control the trust investments, the trust will be treated as a grantor trust for income tax purposes. This is because the Grantor has the ability to direct the trust assets to produce income or capital gains.

Power to Reacquire Trust Assets - Section 673

- If the Grantor has the power to reacquire trust assets, the trust will be treated as a grantor trust for income tax purposes. This is because the Grantor retains control over the trust assets and can “reclaim” them at any time.

Power to Replace the Trustee - Section 675(1)

- If the Grantor has the power to replace the trustee of the trust, the trust may be treated as a grantor trust for income tax purposes. This is because the Grantor has control over the management of the trust and can direct the trustee to take actions that benefit the Grantor.

Power to Substitute Property in the Trust - Section 675(4)

- The power to substitute property in a trust allows the Grantor to exchange property in the trust for other property of equivalent value. The Grantor can use this power to remove assets from the trust that have appreciated in value and replace them with other assets that have not appreciated as much. By doing so, the Grantor can effectively freeze the value of the assets in the trust for estate tax purposes.

Power to Revoke or Amend the Trust - Section 676

- If the Grantor has the power to revoke or amend the trust, the trust will be treated as a grantor trust for income tax purposes. This is because the Grantor has control over the trust assets and can modify or terminate the trust at any time.

Power to Use Trust Assets - Section 677

- If the Grantor has the power to use trust assets, the trust will be treated as a grantor trust for income tax purposes. This is because the Grantor retains a beneficial interest in the trust assets and can use them for personal benefit.

Power to Veto Distributions - Section 678

- If the Grantor has the power to veto distributions from the trust, the trust will be treated as a grantor trust for income tax purposes. This is because the Grantor retains control over the trust assets and can prevent the beneficiaries from receiving income or principal.

Non-Adverse Party Powers - Section 671

Section 671 of the Internal Revenue Code provides the general rule that a trust is treated as a grantor trust if the Grantor or a non-adverse party has certain specified powers over the trust.

In a grantor trust context, a nonadverse party refers to an individual or entity that does not have a substantial adverse interest or conflict of interest with the Grantor. Typically, a nonadverse party is someone who has a close relationship with the Grantor but does not have a conflicting interest. This may include family members, trusted advisors, or entities such as a family office or trust company. The nonadverse party acts in a fiduciary capacity to carry out the Grantor's wishes and ensure the proper administration of the trust. A nonadverse party can be particularly useful where it is best to have a trust be characterized as a grantor trust for tax purposes, but when it might not be advantageous from a practical standpoint for the grantor to actually have the necessary powers for whatever reason.

These powers are:

Power to Control Trust Income or Principal

- Under Section 671(a)(1), a trust is treated as a grantor trust if the Grantor or a non-adverse party has the power to control the beneficial enjoyment of the trust income or principal. This means that if the Grantor or a non-adverse party has the power to direct the trust income or principal to themselves or their creditors, the trust is treated as a grantor trust for income tax purposes.

Power to Control the Trust Investment

- Under Section 671(a)(3), a trust is treated as a grantor trust if the Grantor or a non-adverse party has the power to control the investment of the trust assets. This power allows the Grantor or non-adverse party to direct the trust assets to produce income or capital gains.

Power to Reacquire Trust Assets

- Under Section 671(a)(4), a trust is treated as a grantor trust if the Grantor or a non-adverse party has the power to reacquire trust assets by substituting other assets of equivalent value. This power allows the Grantor or non-adverse party to remove assets from the trust that have appreciated in value and replace them with other assets that have not appreciated as much.

Power to Use Trust Income or Principal

- Under Section 671(a)(5), a trust is treated as a grantor trust if the Grantor or a non-adverse party has the power to use the trust income or principal for their own benefit. This power allows the Grantor or non-adverse party to benefit from the trust assets directly.